YOU CAN ENJOY FINANCIAL FREEDOM LIKE OTHERS WHO INVESTED IN MY "DEAL MAKER BLUEPRINT TRAINING & CERTIFICATION"

“JUST CLOSED ON A 32-UNIT APARTMENT BUILDING AND QUIT MY JOB!”

I have used the Syndicated Deal Analyzer and everything that Michael taught me to analyze over 20 deals. It has cut down on the time it takes to come up with an offer price so that I can make more offers. I just closed on my first large apartment building deal, a 32-unit, and am confident that I can do another one or two deals this year. And I'm happy to report that two weeks ago I quit my job! A dream come true. Thanks, Michael for all your help!

Drew Kniffin

MINNEAPOLIS-ST. PAUL

“AFTER 4 MONTHS TO DO FIRST DEAL – 69 UNITS – NOW OWNS 500+ UNITS”

It took Patrick Duffy just 4 months after joining the program to close his first deal – 69 units – by partnering with Michael Blank’s team. He paid himself a nice $19,038 acquisition fee check at closing. Since then, he has quit his job and closed another 500 units.

Patrick Duffy

“9 MONTHS TO FIRST DEAL – TODAY 300+ UNITS AND $15K IN PASSIVE INCOME”

I closed on my first apt building deal, a 130+ unit in the Dallas/Ft Worth metroplex – 9 months after joining Michael's program. That program dramatically increased my confidence, and I was then able to analyze, negotiate, and put this property under contract. That first deal added about $8,000 to my monthly income. 6 months later I closed on 110 units and 6 months after that, another 80 units. These deals are now generating $15,000 per month for me and my family. Thanks, Michael, for all your help!

Bruce F.

TEXAS

“QUIT MY JOB 12 MONTHS AFTER JOINING MICHAEL'S PROGRAM!”

I took Michael’s Ultimate Guide course in early 2017 and closed my first deal January 2018 and am now doing this full time. And I just want to say, thanks for giving back Michael.

Ben Risser

LANCASTER, PA

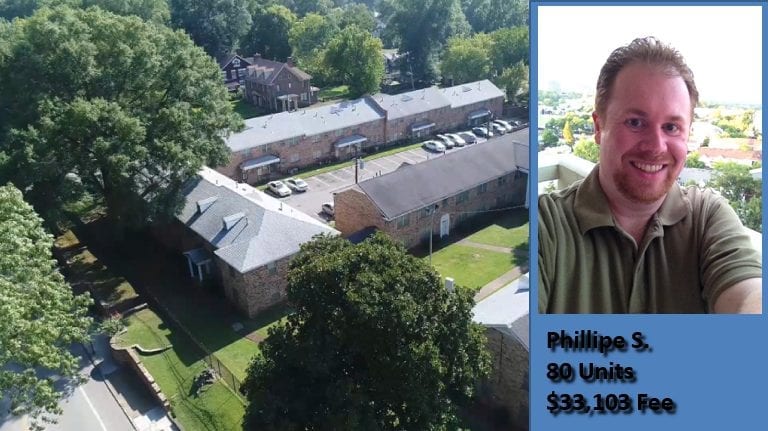

“FIRST DEAL 5 MONTHS (80 UNITS) – THEN 168 UNITS – $60K IN ACQUISITION FEES”

It took Philippe S. to close this 80 Unit deal just 5 months after joining the Ultimate Guide program . 6 Months later, he closed on 168 units – paying himself over $60,000 in acquisition fees.

Philippe S

“I DID MY FIRST 22-UNIT DEAL IN 3 MONTHS (THANKS MICHAEL!)”

Three months after joining Michael’s program I closed my first apartment building deal with two investors (a 22-unit in Florida). My goal is $10,000 per month so that I can quit my job if I want to. I’m working on a 50-unit now, and once I have that closed, I’ll need one more deal and I’m there. Michael, thanks so much for all of your help!

Ed Hermsen

FORT COLLINS, COLORODO

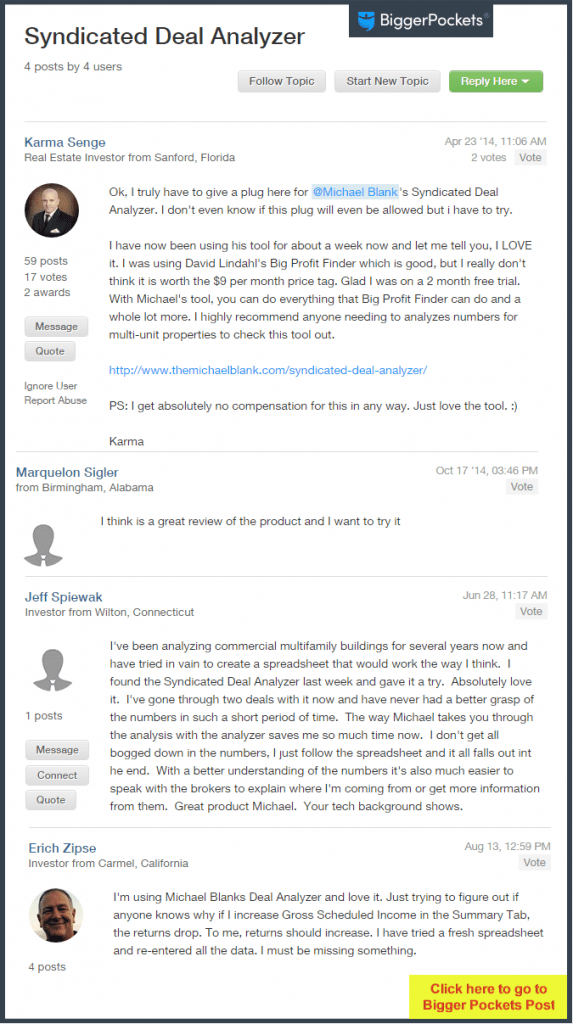

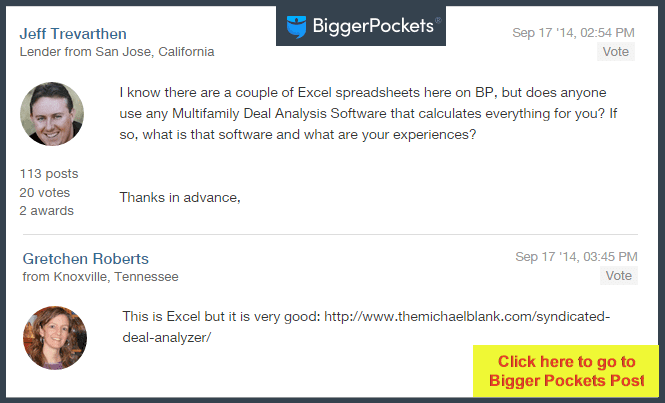

I used the Syndicated Deal Analyzer to analyze my first deal and I’m impressed with the results. I’m not in due diligence yet, so I ignored some of the more advanced features and focused on calculating my max buy price, which I was able to do in less than half an hour. I also like the fact that I can completely customize the calculator. I am planning to have investors in the deal, so having that included in the projections is key for me. I’ve been used to residential investments. So, I was not sure where to start with commercial calculations. Building my own would take me hours and probably months of work. I would highly recommend it to anyone serious about investing in apartment buildings, with or without investors!

Jonathan Mickles, REALTOR, CIAS, CDPE, @gr8fulbishop

The deal analyzer has been a no brainer investment. Having me and my investors returns calculated quickly and easily visible in the summary section allows for a quick analysis of different scenarios to see if a deal will work or not. This makes my life quicker and easier. It’s for investors created by an investor and allows me to edit the formulas to my needs when necessary. On my last deal package I spent hours putting together the financials and getting them into my powerpoint presentation. My next shouldn’t take me more than an hour with this tool. Well worth it…and at $100 its a no brainer. My only issue is not having a user friendly iphone app to go with it!

Scott Isley, San Diego CA

I’ve really enjoyed using the Syndicated Deal Analyzer. It makes deal analysis easy and quick compared to other programs that I’ve tried. I like how it puts analysing the syndicate and property all in one program. I would recommend the Syndicated Deal Analyzer to anyone serious about syndication.

Allen F, Westerville, OH

As a syndicator/sponsor of several real estate deals, I have tried lots of different software, cash flow models, etc. Most of them I would just end up modifying so much to the point where I simply created my own version. The Deal Analyzer from Michael Blank is easily the best one I have used to date. It is very detailed and really caters to the sponsor who is looking to analyze a deal targeted to his or her investors. The projections are well laid out, specifically the 5 and 10 year return sections which do a great job showing the sponsor and investors how the deal will play out over the targeted hold period. In all I am very pleased with the Deal Analyzer and would highly recommend to any syndicator looking for a detailed model to quickly project cash flows and returns to both the sponsor and investor over a specified time period.

David Lamattina, Andover MAPrincipal, Arrowpoint Properties, LLC

I think the Syndicated Deal Analyzer is very practical for analyzing deals. It incorporates all of the underwriting requirements I look for when I get a loan package. As an investor myself, I really like the rules of thumb so that users can get an idea of how legitimate (or, more likely, illegitimate) the seller’s financials are compared to what they should expect when owning the property and properly managing it. It really takes a lot of years and seeing a lot of transactions, appraisals, etc. to really understand the true expenses. And nothing is more important than being able to put together real (and conservative) projections. Also, it is important to understand how lenders will view the operating statement when calculating debt coverage, especially so with apartments where cap rates are typically low and meeting debt coverage requirements are very important to maximizing loan proceeds. I really think that someone could utilize this tool to buy their first apartment building and not encounter a lot of mistakes that would be typical for a first transaction.

Adam Scherr, CCIMPrincipal, Noteworthy Commercial Finance

I went ahead and purchased your deal analyzer, watched the videos, and assessed the analyzer itself. Forgive me when I say this but, F’ing A this thing is awesome! I can’t imagine how many hours you put into developing this spreadsheet but thank you for doing it! This is definitely a “work smarter not harder” kind of resource that I will be using exclusively from now on. I’ll be using it this week to assess an off market opportunity that is 2 properties and 29 units total. I’ll keep you in the loop

Paul Z

Michael’s Deal Analyzer is great because it prepares you to focus on all of the various aspects of putting your deal together to provide you with the desired outcomes to achieve/exceed set goals for each party involved in your transactions.

Rob C, Los Angeles, CA

Just a note to say thanks. I did use the software on a little 7 unit complex I’m in contract for with a partner. Picking it up at a 9 Cap performing and will be close to an 11 once optimized at around 10K gross a month. Thanks for your help with the software as it was easy to go through everything and get it over to my investor. Thanks again.

Adam J, Santa Rosa, CA

The Syndicated Deal Analyzer is an excellent tool allowing both novice and experienced investors to analyze deals quickly and efficiently. Being able to provide a clear and concise side-by-side analysis of actual and pro forma data is invaluable when presenting information to potential investors. The Syndicated Deal Analyzer has truly made analyzing investments easy.

Brendan K., Pittsburgh, PA