Volatility has an enormous impact on your portfolio, and it’s a critical factor in making decisions around where to invest your money.

Stocks or real estate? Or something else?

In this week’s video, I show you why the ACTUAL return of the stock market over the last 20 years was actually MUCH lower than you might think.

Makes me mad!

It’s yet another reason to take at least SOME of your money out of the stock market and into something more consistent and predictable like multifamily syndications.

Watch this shocking video below (or keep on reading).

Remember the story of the tortoise and the hare? Investing is actually a lot like that: The hare seems to be the better investment if you consider his speed alone. But if his speed does not remain consistent, if he stops to take a nap, for example, the tortoise will come out on top. And in the end, slow and steady wins the race.

Volatility has an enormous impact on your portfolio and your net worth, so when you make decisions around where to invest your money, it’s important to look beyond the average annual return and consider likely fluctuations in the market.

The S&P 500 index earned an average rate of return of 6.8% the last 20 years (from 1998 to 2017) – which seems like a reasonable return. Most financial advisors and stock investors use that (or a similar average annual return) to project their returns into the future.

But that assumes the return was consistent each year, which it wasn’t. In fact, the ACTUAL return was only 5.2% over that same time due to the volatility of the stock market – and that was before fees.

Don’t believe me? Let’s dig into the numbers so you can see what I mean.

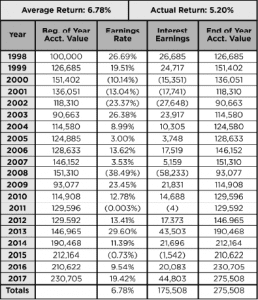

Let’s dissect this simply. From 1998 to 2017—a period of 20 years—the S&P 500 index earned an average rate of return of 6.78 percent according to Pinnacle Data Corp.

What does this mean?

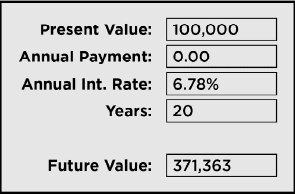

The average American doesn’t really know. They see these numbers and erroneously conclude that if they had money in the stock market, their wealth would grow by 6.78 percent yearly. Using that logic, a $100,000 investment would turn into $371,363 over 20 years.

That’s a lot of money, but it’s not how the market works. If that $100,000 were invested in the S&P for 20 years, that’s not what it would have earned.

Here’s How Volatility Crushes Your Returns

Markets don’t operate on a straight line – they go up and down. If you started with $100,000 at the beginning of 1998 and cashed out at the end of 2017, your balance would be $275,508—almost $100,000 less than what the average would have been.

Why?

Because markets fluctuate. When there’s a loss, a subsequent gain must be much higher to balance out the loss. If you lost 10 percent on a $100,000 investment, your balance would be $90,000. To make up the loss and get back to break-even, you would have to earn 11.1 percent, not simply 10 percent. That’s because if you lose 10 percent one year and then gain 10 percent the next, your average return over the two years is zero percent.

The shocking ACTUAL return of $100,000 invested 20 years ago is NOT 6.78% – it’s actually 5.2% (and that’s before fees) — check out the following chart:

When you factor in the fee structure, which is how the fund manager is paid, the results worsen. When the management fee is just 1 percent, the balance erodes to $225,340, or a 4.15 percent return.

Looking for an Alternative Investment with More Consistent Returns?

This means that an investment with a CONSISTENT 7% return yields MORE in the long run than a 12% average annual return that fluctuates a great deal. And this is what makes multifamily investing a much safer bet than the stock market.

At Nighthawk Equity, we look for deals with a projected 13%-15% annual return. In addition, investors receive their annual cashflow distribution AND a payout when the property is sold. Put $100K in a multifamily syndication at a steady 15% return, and you double your money in five years.

Try that with the stock market!

At the end of the day, the lack of volatility in apartment buildings makes them a much more attractive investment than stocks. With the hare’s speed AND the tortoise’s consistency, multifamily gives you the best of both worlds, allowing you to make the most of the capital you’ve got—and live happily ever after.

Interested in Investing with Us? Then Join the Nighthawk Investor Club!

[button link=”http://nighthawkequity.com/” newwindow=”yes”] Join the Nighthawk Investor Club[/button]

**mitolyn**

Mitolyn is a carefully developed, plant-based formula created to help support metabolic efficiency and encourage healthy, lasting weight management.