If you're ready to take the next step with your apartment building investments, download ALL my resources for FREE at this link: https://themichaelblank.com/vault

Getting a handle on the prevailing market rents is critical for the business plan of your rental or multifamily property. Your property’s rents may be under market, but how do you know for sure? What rents should you use for your financial projections? What kind of concessions will you have to provide to fill your units?

A rent survey answers these questions, and here are the 4 steps to create one.

4 Steps to Perform a Rent Survey for Your Investment Property

Step # 1: Create a Spreadsheet to Compile the Results of the Rent Survey

For each type unit (one, two or three bedroom), create columns for:

- Rent per month

- Size of unit in square feet (SF)

- Rent / SF

- Deposit

- All bills paid?

- Specials

- Other comments (i.e. upgrades, amenities offered, such as laundry facilities, pools, etc.).

Step # 2: Get Rental Data from Comparable Properties

In this step, you want to complete the spreadsheet with as many different comparable properties as you can. Here are different 5 tips to help get that information.

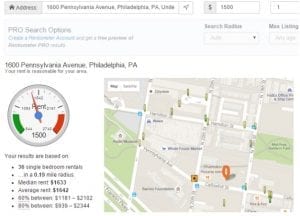

Tip #1: Use Rentometer.com to do an arm chair rent analysis.

Go to www.rentometer.com and type in an address, and the website will tell you what the median rent is and show you a map of the comparable units.

This is one of my favorite sources for rental comps because you get a good number of data points, and I’ve found the accuracy to be good.

Tip #2: Visit other rental sites like Apartments.com and Craigslist.com and search for similar units in the area.

Note the size and price of these units in your spreadsheet.

Tip #3: Ask a real estate friend to get you access to the local Multiple Listing Service (MLS).

There, you can search for rented apartments, and it’ll give you the rented price, how long it took to rent, and usually at least a photo.

Tip #4: Visit listed apartments.

You can do a lot of work online, but you’re missing one piece of important information: the condition of the area, the building, and the unit itself. These all affect the rent of an apartment. The only way to get this information is by visiting some of the apartments you found online.

Make a list of some of the apartments in the immediate area of your building and make an appointment to see them. After seeing them yourself, you can more readily compare them to your building.

You might also learn things from visiting these other buildings. For example, maybe the competition has some advantages, like access to washer/dryer or an awning. Or maybe they’re offering a free month of rent free as an incentive.

Information like this gives you ideas of how you can be the most competitive you can be. First-hand knowledge also makes your financial projections more reliable and also more believable to the investors.

Tip #5: Get a rental survey from your property manager.

The better property managers ALWAYS have current rent surveys on hand. They know the condition, size and price of competing units and know about any type of specials or concessions. These surveys are great because they’re normally very comprehensive and up-to-date.

Tip # 6: Get rental comps from your broker.

If the building you’re looking at is listed by a larger, reputable broker, then chances are good that the broker has access to rental comps in that market.

Step #3: Compile the Data in the Spreadsheet

Using all of these sources, compile the data in your rental survey spreadsheet. You might have to call the apartment’s leasing office to get some of the missing data. For example, you might have to call to get the size of the units or learn whether there are any specials. You can estimate the condition of the property by using Google Earth, though a drive-by or property visit is going to be more accurate.

Shoot for at least 6 comparable properties.

Step #4: Interpret the Results

Focus on the “Rent/SF” metric because that helps to compare one property to another. Make adjustments for condition, amenities, and whether or not utilities are included.

Based on those averages, compare them to the rents/SF of your subject property. Now you have a pretty good idea of where the market is and what rents you should use in your projections. You now also have a good idea what improvements you should make to your property or what amenities or move-in specials you might need to offer to be competitive.

Doing a rent survey is critical for the business plan of your rental or multifamily property. Don’t miss out on this valuable tool — follow these steps to get it right.

Do you perform rent surveys for your properties?

Leave your questions and comments below!

Your article helped me a lot, is there any more related content? Thanks!