Make sure you download ALL my resources for FREE at this link: https://realestateempire.co/

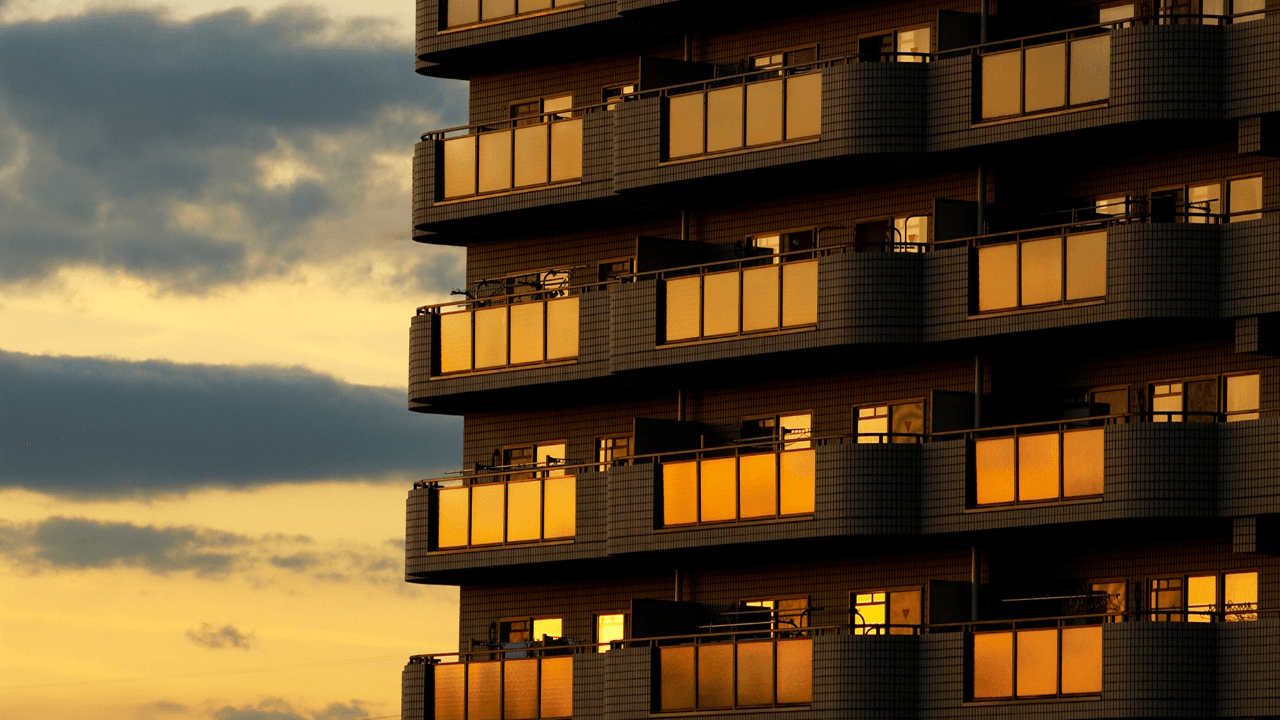

You’re not going to find your way to financial freedom flipping houses. But what about commercial real estate? Can you flip an apartment building?

First, let’s examine what that term actually means.

If you flip an asset, you purchase with a short holding period (generally less than a year) with the intent of selling it for a quick profit, rather than holding on to it for the purpose of long term appreciation.

Flipping refers to short-term real estate transactions – although you can flip other assets as well.

People make money flipping real estate, but there are risks. Flipping in a hot market, for example might backfire as markets can cool unexpectedly. If market conditions change before your property can be sold, you might find yourself holding a depreciating asset.

We generally have a four to five year hold on our properties, but the whole point of flipping real estate is to make a profit. While we have other goals with our syndications – like improving quality of life for our tenants, I want to share a story with you about how you could add $1M to your net worth in five years by purchasing a 21-unit apartment building.

I first got started in real estate by flipping houses. Not long after I made that decision, I met an experienced investor who owned multifamily properties. He pointed out to me that in commercial real estate, there are three ways to make money, while flipping houses only offered one.

In commercial real estate investing, you can make money with:

1.cash flow

2.tenants paying down the loan

3.appreciation

Let’s say you purchase a 21-unit apartment building at fair market value and the current average income per unit is $1,000 a month.

The property manager has kept up on repairs. They have chosen not to raise rents, so turnover is low, but operating expenses are high.

The rents in the market are $200 higher per unit, maybe even more. If you make upgrades to the property, you and your property manager could decrease expenses by 10% over a year or two.

You purchase the building at an 8% cap rate. Your goal after two years it to have increased the average income per unit by $100 per month and to have decreased expenses from 55% of income to 45%.

Let’s go back now to those three ways of making a profit with commercial real estate. If you factor in cash flow, loan amortization, and appreciation, your profit after you sell in five years is one million dollars.

Commercial real estate is the very best way to achieve your financial goals.

No other business allows you to leverage your time, money, and skills in the same way.

After my meeting with that experienced investor, back at the beginning of my career, I vowed to get out of flipping houses – even though it was profitable – and get into apartment building investing.

I believe this is the pathway to financial freedom.