The real estate market never stays the same. Every quarter, things are changing. One time rents are going up, and other times the rents are trending down.

Right now, we're seeing something that's making a lot of investors nervous: rents in most markets are projected to be flat or mildly down.

After years of steady rent growth, many investors built their business models around consistent increases. Now they're asking tough questions about how to keep buying and scaling properties when the fundamentals have changed. In this article, I’ll show you how we’re rethinking the way we approach deal analysis in flat or declining rent markets.

Make sure you download ALL my resources for FREE at this link: https://realestateempire.co/

Investing out of state may sound like a scary proposition.

Does it really work to own property miles away from where you live?

To answer that, let’s unpack some of the risks of investing out of state.

You may think your distance from the property would be an impediment to building maintenance.

Isn't proximity to the building important in the case of an emergency or a repair that needs to be made as soon as possible?

This is where property managers come in.

The right team is integral to your success. When you hire a property manager, you hire someone who will not only handle phone calls and day to day operations, but also help you when something needs to be fixed, or an unexpected situation arises.

Your property manager will be on hand to assist tenants with maintenance requests and oversee the process of preparing properties for new tenants. They will work with the leasing agents and it's their job to maintain relationships with local contractors like plumbers, landscapers, and electricians.

Hiring a team you trust will ensure that even when you are not handling a problem directly, you have assistance.

A good property manager can also serve as your eyes and ears, to help make sure you have reliable tenants. When tenants move out, the property manager will inspect the apartments for any damage.

You might be concerned about finding a property if you’re not physically in the market, looking around, getting a sense of the area.

In today’s world, however, we are more connected than ever before, and have access to information at the stroke of a keyboard.

You can use tools like Google Maps to explore property from a distance, before you visit.

Of course, the best way to make certain your investment is sound is to invest in the right market.

At Nighthawk Equity, we focus on Class B and C properties. If you look back at our history of deals, we find properties that have the potential to be great, in great neighborhoods, that have just been not cared for on some level.

We improve the property, and add value for tenants and investors.

Why would you invest out of state?

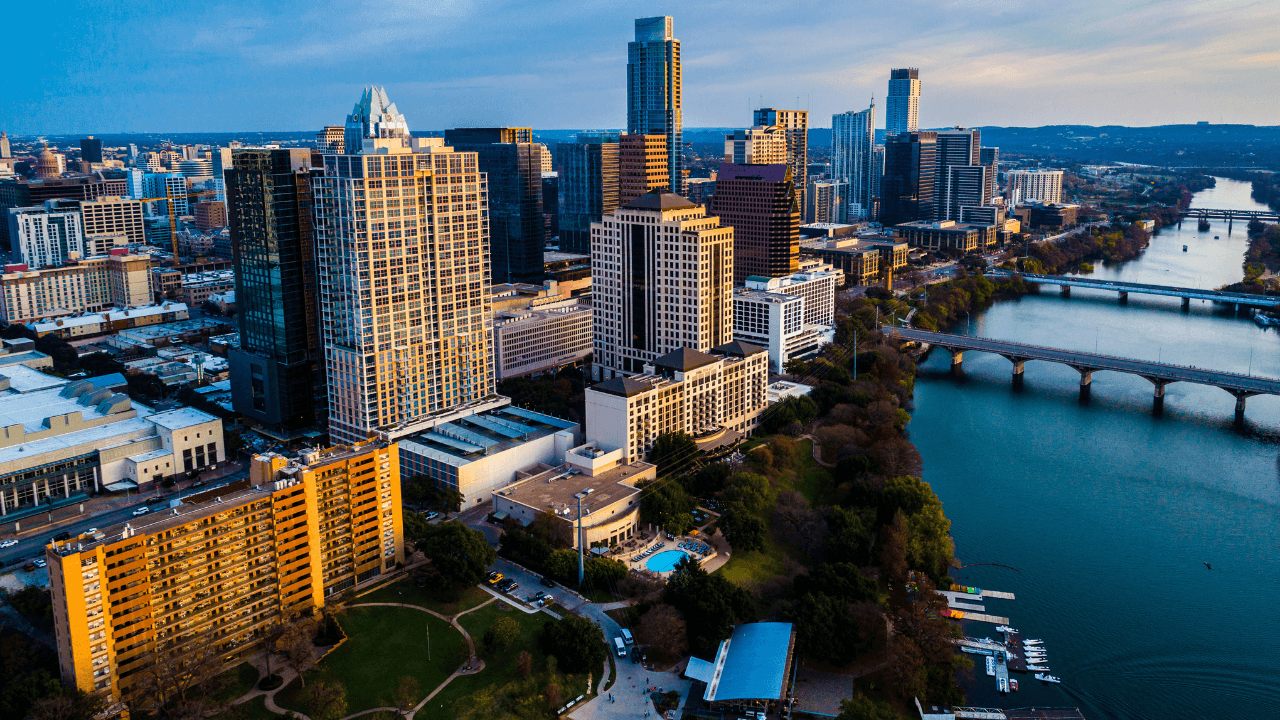

When you invest out of state, you can shop for the market that’s right for you, one where operating expenses are lower, for instance, where property taxes are lower, or where the law is landlord-friendly.

Expanding your scope allows you to invest in a geographical area where job growth is strong; diversify your portfolio, which is a key strategy used to reduce risk; and reap a greater ROI because you are able to invest in a market that makes sense for you.

Like all investments, investing in out of state rental property does come with some risk. You can mitigate those risks by investing in the right way, hiring a reliable property manager, doing your due diligence, and investing in the best market.

Overall, this strategy can bring you an increase in cash flow and diversification of your portfolio.

Not only is it possible, there are great advantages to out of state investing.