As I continue to teach real estate investors how to buy apartment buildings with a focus on raising money from others, I've noticed that some people are more likely to succeed than others.

Why is that? And more importantly, what traits most contribute to someone's success?

Wouldn't that kind of information be helpful to a real estate investor before they spend good money on courses and coaches?

I've concluded that there are 5 factors that determine the success (or failure) of a new real estate investor:

- The strength of their WHY.

- The size and achievability of their goals.

- The amount of their own money or access to other people's money in their network.

- How much time they dedicate to the strategy each week.

- How much of an action-taker they are.

There are probably other factors, but these are the ones I think make the biggest difference to whether they'll be successful as real estate investors.

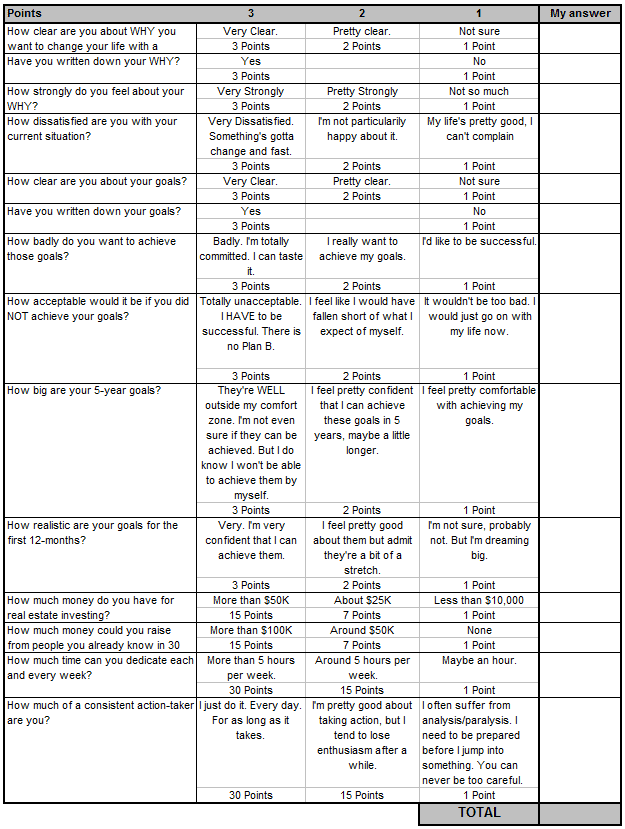

To find out where YOU live on the success/failure spectrum, take my quiz below.

But first, some disclaimers:

- I'm not a certified statistician or other social scientist.

- This survey is intended to give you a general idea of how successful you might be in real estate investing and to identify your strengths and weaknesses.

- Having said that, this is only for educational purposes. Don't make any major life decisions based on the outcome of this survey. Don't complain to me later that “I gave you bad advice”.

- This quiz represents my current understanding of likely success or failure. It's neither complete or conclusive, and I'll probably change my mind later.

With that out of the way, take this quiz and see how you do. For each question, choose the best answer for the question and write down the appropriate number of points in the column to the right. When you're done, add up the numbers and see how you did below.

How Did you Score?

If you Scored Under 42 Points

Seriously examine if you have what it takes to succeed in the real estate business right now. I say “right now” because with some extra work (that I describe below), you can retake the survey later and maybe score higher. But you have some work to do before you buy that first course or hire a coach!

Your WHY: You're not clear about WHY you want to get into real estate investing in the first place. Take some time, think about what you don't like in your life and what you want. Discuss it with a spouse or friend. Then write it down.

Goals: Regarding your goals, you don't have any. Or they aren't big enough. Or you're a dreamer. Sit down and really write down your goals. They should be measurable, specific, and have a deadline. You should dream big, yes, but your 12-month plan should be realistic. Don't tell me you want to own 1,000 units when you have no track record with multifamily investing. You're just lying to yourself and wasting my time.

Money: You don't have any of your own capital nor the network to raise any. How are you going to buy the course or coach you need to get the proper education? You'll have a hard time putting down a deposit on a property or paying for the due diligence costs. Which means you'll have to raise the money. If you don't know anyone with any money, you'll have to work harder and longer to build your network. Not impossible, just realize that it will take more time.

Time: Speaking of time … you don't appear to have any. That's probably because you're too busy watching news and sports every day. Normally the lack of time isn't really a lack of time. It's a lack of priorities. Examine your priorities in life. If real estate investing is not a high priority (and watching TV is) then you spend your time accordingly. You'll have to make some decisions about what's really important in your life.

Action: And to top it all off, you're not really a consistent action taker. You talk a good game, maybe even read a book or two and attend REIA meetings, but you really never do anything. You're too careful. You're easily overwhelmed. And you're afraid.

My advice? Write down the next 3 things you know you should THIS week to get you closer to your goal and then do them. Find an accountability partner. If you can't take consistent action, you will NEVER change your life.

If you Scored Between 43 and 95 Points

You have a great combination of traits and circumstances that will give you a high probability of success in the real estate business. But, you have some challenges and weaknesses that you need to be aware of, and you'll need to work to improve them or overcome them by partnering with others.

Your WHY: You might need to examine WHY you want to get into real estate. Make it more about just money or about you. Go deeper. And, write it down.

Goals: Take another look at your goals. Are they TOO big? Are your 12-month goals so big that there's no possible way you can achieve them in your lifetime? Or maybe they're too small. Maybe you need your stretch yourself a little. And … are they written down?

Money: You have some of your own financial resources and you know some people with money. That may be enough to do your first, smaller deal but you're going to have to hustle to do larger deals. Not a problem: get to work. You'll raise the money eventually if you stick with it.

Time: You might be struggling with dedicating the hours to the venture. Maybe you have a demanding job (or spouse :). Not ideal. You'll have to carefully set priorities and get the support from your family. Some things may have to be sacrificed. It's imperative that you put the necessary time into this venture or it will not succeed.

Action: You're pretty good with taking action initially, and you can quickly get excited about something and hit it hard and heavy. But after several weeks or months, when things take a little longer than expected or you've had some challenges or delays, you tend to lose your enthusiasm and your initial excitement turns cold. This is why developing your WHY and your goals are so important. Review them now, and remind yourself why you started on this journey in the first place.

If you Scored More than 96 Points

You have an ideal combination of factors that will make it very likely that you'll be successful with real estate investing.

You know exactly WHY you need to be successful in real estate. That WHY is not just about money, or about you. It's deeper than that, and it's normally for other people you care about.

You have big, hairy goals that scare the &*$#! out of you. But your 12-month plan is grounded in reality if you work hard enough and involve the right people on your team.

You have some of your own money to invest and you know others who are willing to invest with you. This speeds up the money-raising part of your venture significantly.

You're making this a priority, so you're dedicating a significant amount of time, even though you have a full-time job and other commitments.

And you have a history of getting it done. Every day. For as long as it takes.

If this describes you, and you want to get started with apartment building investing, I want to be your coach. Call me now.

Well, even if we don't end up working together, it looks like you've got what it takes. Now go out there and get it done!

Let me know how helpful you found this exercise. How did you score? What did you learn about yourself? What do you need to do next?