Make sure you download ALL my resources for FREE at this link: https://themichaelblank.com/vault

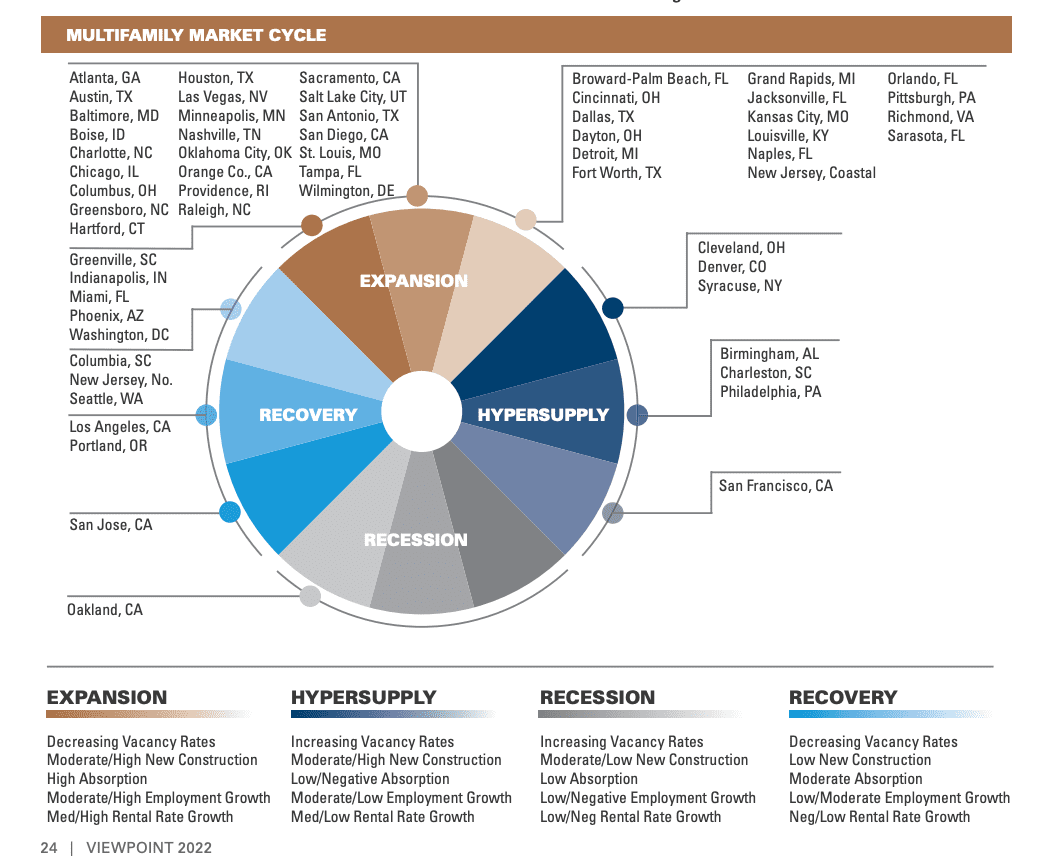

Understanding the multifamily market cycle is key to your success.

You need to know which markets are the best areas to invest in and that means understanding the market cycle.

There are four phases to the market cycle.

It starts out in the recession, moves into recovery, then into expansion, and finally, hyper supply. You want to key in on markets in the middle, that are in the recovery or expansion phase.

When we look at expansion markets, we’re looking at things like:

- decreasing vacancy rates

- high rates of new construction

- high employment growth

- high rental rates

Similarly in the recovery phase, we’re looking at:

- decreasing vacancy

- low to moderate construction

- trending toward the next phase, which is an expansion

In the recovery phase, vacancy is decreasing. There's low to moderate construction, but the construction is trending toward higher numbers. That's when you know you're moving toward the expansion phase, and an expansion phase is a great spot to be in.

When you see cranes all over the skyline, you know you have high employment growth, you have companies moving into the area and expanding, and you have high rental rate growth.

If you're an investor looking for a syndicator, you want to make sure they're operating in the right phases of each market cycle.

Cross-reference those markets with the report that articulates these supplies, the IRR viewpoint report. It goes into detail about each multifamily market, and what phase of the cycle they're in. Look up data on different markets and figure out whether or not they're growing.

In our experience at Nighthawk, we have found that our two key markets, Huntsville, Alabama, and Atlanta, Georgia, are right in this expansion phase. They're growing like crazy with high rates of rental growth and a lot of new properties being built.

We found tremendous success there because that's the sweet spot that that that you want to be in.

Our advice to you is to research syndicators and work with those investing in high-growth markets.