Make sure you download ALL my resources for FREE at this link: https://realestateempire.co/

New Trends in Real Estate Investing

What current trends are we seeing that impact real estate investing?

There's one big trend no one can ignore, and that's inflation.

Unless you're sleeping under a rock, you're probably thinking about inflation all the time. The new rising interest rate environment has had a huge impact on all asset classes, including multifamily.

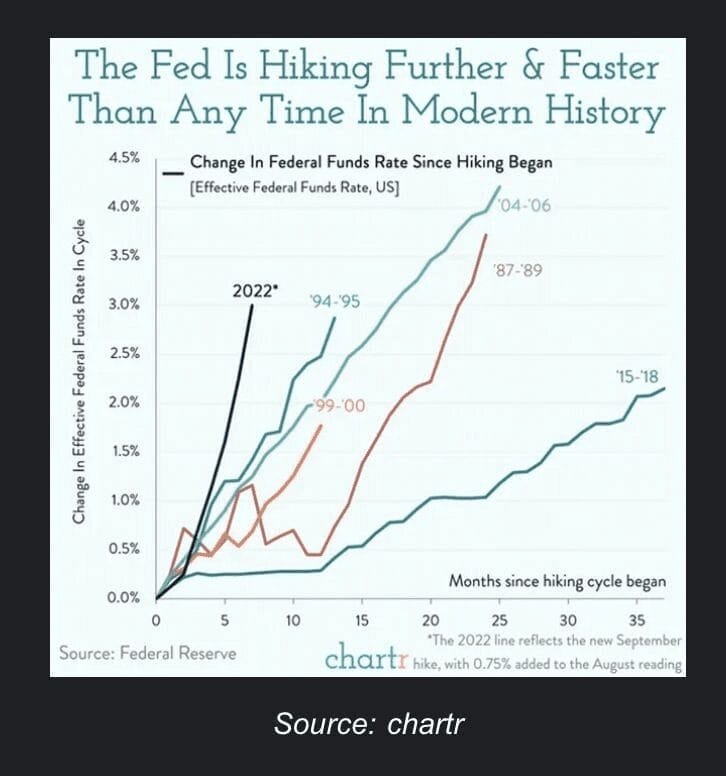

Right now, inflation has a grip on the economy, and the Fed is raising rates at the fastest pace they've done since 1980.

That is seriously impacting how we do deals.

Debt is more expensive, the price of money is moving around more quickly, and it's definitely adjusting what properties are worth, what banks are lending, and the appetite that investors have for going into these deals.

The good news is, that's providing a lot of opportunity. Investment groups that are keeping a strong balance sheet, and have the ability to run strong operations, are going to endure. Others will have a tougher time.

What are we doing about it?

We're continuing to focus higher, with more emphasis on our operations, unit renovations, and leasing collections.

We're also doing our underwriting differently. We're buying industry caps. We can pass on much of the risk of volitile interest rates on to a counter party. And we're buying caps at a closer price to what we call the strike price to even further reduce risk. This limits some of our exposure, and allows us to be better positioned to endure whatever the future holds.

Now, how about from a micro economic perspective? What are some trends to look into there?

Of course you remember, just 12 months ago, COVID. During the pandemic we saw a lot of people saying, “Oh, I'm going to work from home, I want more space.”

And when you want more space, where do you find it for the same dollars? Usually by moving out from the core metro areas.

That's exactly what we've seen – people moving out from downtown areas into the suburbs.

As a result, what we've seen rental increases happening at a higher rate, the further you are from the Metropolitan core. We have a property, for instance, that we just purchased 20 miles outside of Atlanta. That property is really benefiting from this trend. As you drive into it from Atlanta, you just see building after building after building because the path of development is out toward these outlying metro areas.

That's one of the big trends we're seeing right now.

Remember, as always, multifamily is a great hedge against inflation.