In today’s article, I’m going to break down the most common real estate investing methods and show you which one is the best going into 2025. I’ll discuss flipping houses, buying single-family rentals, the BRRR method, short-term rentals, and multifamily.

Because I love numbers and using different metrics for analysis, these are the criteria I’m going to use:

#1: Short-term income. How much income do you make in the first few months after doing a deal?

#2: Cash flow (passive income). How much residual income do you make over the next few years after buying a property?

#3: Building wealth (long-term appreciation). As you hold this property, is it going to make you wealthy so you can retire? Ideally, you want to be earning strong cash flow today and building wealth so you have a multi-million dollar net worth.

#4: Capital needed. We’ll talk about how much capital you need to do your first deal AND how much capital you need to keep in a deal. I know so many people that have $50K or $100K to invest and if you do something like single-family rentals, that will only get you 1 or 2 rentals.

Versus there are other ways to invest in real estate where you get your cash back QUICKER so you can go on to do the next deal and next deal and actually scale your portfolio.

#5: Risk. Because what good is making a bunch of money if you lose it all?

#6: Tax benefits. If you own a successful business or are earning a six-figure income, you’re likely paying a TON of taxes. You can reduce taxes with real estate, but not all strategies are created equal when it comes to taxes.

And one of the key benefits of real estate is reducing that tax burden.

Let’s dive in.

Source: Candis C. Real Estate Buyer's Agent, Seller's Agent, REALTOR® in Pinellas County FL, ABR, SRS, PSA, ePRO, AHWD, CSA

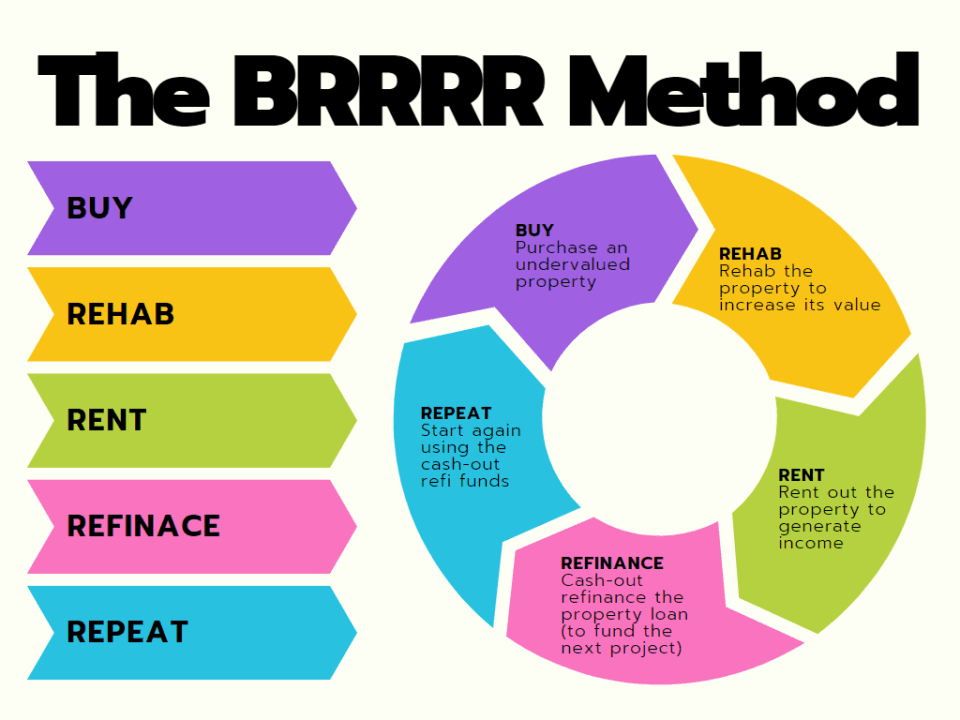

BRRRR Method

- Short-Term Income: Bad

- Cash Flow (Passive Income): Low ($100-200 per month.)

- Building Wealth (Long-Term Appreciation): Good (Forced appreciation)

- Capital Needed: Mid to High

- Tax Benefits: Mid. (Likely can’t do a cost segregation study and if you sell the house within a year, you can't get depreciation)

- Risk: Mid to High.

- Market Risk: If you need to sell your property, you’re relying on the market. If the market is down, so are the rentals.

- Single-Tenant Risk: If your tenant moves out, you’re on the hook for the entire mortgage until you can find a new tenant.

- Risk: Mid to High.

- Scalability: Low. Can take up to a year to get your initial investment back.

The BRRRR method, which stands for Buy, Rehab, Rent, Refinance, and Repeat, is a strategy often highlighted in the media. It involves purchasing a property, refurbishing it, renting it out, and refinancing it to pull out the initial investment, then repeating the process.

Short-term income from these investments is typically low since the property doesn't generate profit immediately upon purchase. The cash flow from renting out these properties can also be less than expected, often yielding only $100 to $200 monthly.

Prospective investors might need around $100,000 to make a down payment on an average-priced home. The risks include market fluctuations and tenant issues, which can lead to periods where the property generates no income.

It’s also difficult to scale because your money is tied up until you refinance the property. This means it can take about a year to get your initial investment back, so you can only buy one property per year.

If you do the math, you need a lot of rentals to replace a 6-figure income. If every property generates $200 per month in cash flow, you’d need 50 rentals to make $10,000 per month. That’s a lot of rentals!

Finally, there are lending limits on residential rentals: Most lenders following Fannie Mae and Freddie Mac guidelines will allow financing for up to 10 properties per borrower. However, many banks set their own lower limits, often around 4 total financed properties.

Bottom Line: I like the BRRR method better than flips because you’re at least starting to build passive income, and it’s less transactional than flipping. But it’s still hard to scale because you need a LOT of rentals if you’re replacing a 6-figure income.

Short-Term Rentals

- Short-Term Income: Bad. (No profit when you buy the property)

- Cash Flow (Passive Income): Mid to High. (But it’s been declining as more investors enter the market)

- Building Wealth (Long-Term Appreciation): Good (Forced appreciation when you buy and renovate the property).

- Capital Needed: Mid to High. (Banks are eager to lend, which is good)

- Tax Benefits: Mid. (Residential properties depreciate less than CRE and you likely can’t do a cost segregation study)

- Risk: High. (Need to coordinate guests, cleaning crews, and more maintenance due to increased wear and tear.)

- Scalability: Mid. (Don’t need a lot of properties to replace your 6-figure income)

The rise of platforms like Airbnb has popularized short-term rentals, a strategy that saw significant uptake during the pandemic due to the surge in domestic travel and changing lifestyles.

Initially, properties under this model do not offer immediate profits, similar to traditional rentals. From what I’ve seen, most good short-term rentals can earn $1,000-$2,000 per month. However, the profitability has been declining over the past several years, as more STR investors entered the market.

I have a friend in the space, and he’s reporting that over half of his rentals are now at or below break-even. The trend is not good at the moment.

The good news is that if you buy in the right location, your property’s value will go up year over year. Banks are also eager to lend, which is good. For the down payment, if you want to raise capital, you have to make sure the property is very profitable; otherwise, you’ll have to bring your own cash equity.

The average home in America is ~$400k, meaning you need 25% down or $100,000. Short-term rentals tend to be in vacation destinations where real estate is more expensive, PLUS to create a good short-term rental you likely have to invest in amenities and high-quality furniture to attract guests.

So you’re looking at $100k or more to buy the piece of real estate PLUS $20-$50k or more to renovate and furnish the property.

Bottom Line: I like this strategy better than flips or traditional rentals. But you REALLY have to know what you’re doing. And the market risk is pretty big, i.e. it’s difficult to predict how quickly other investors will be moving into the market, which will reduce rents and income, and therefore the risk.

- Short-Term Income: High. (3% acquisition fee at the close)

- Cash Flow (Passive Income): High.

- Building Wealth (Long-Term Appreciation): High. (Commercial property is valued based on how much income it produces, not its location)

- Capital Needed: Low to mid. (You can use other people’s money for the downpayment)

- Tax Benefits: High. (You can get more depreciation sooner by doing a cost segregation study, which currently allows you to depreciate about 60% of your investment f within the first year.)

- Risk: Low. (Multifamily properties do NOT suffer from single-tenant risk)

- Scalability: High.

Back in 2005, I quit my job after reading a book called “Rich Dad Poor Dad” because I wanted to earn money without working too hard and build wealth on the side. I started with renting out single-family homes and flipping houses.

Over three years, I flipped 36 houses and had a few rentals. This made me some money, but only when I was actively buying and fixing houses. It felt like I had just traded my job for another job.

When you buy an apartment building with other investors, you get an “acquisition fee” for finding and managing the deal. The standard fee is 3% of the purchase price. So, if the building costs $4 million, that's $120,000 for you right when you buy it.

On a typical $4 million building, you can make about $42,000 a year in cash flow, plus $12,000 from an “asset management fee.” That adds up to about $4,500 a month in income. That’s way more than the $100-200 per month you'd get from a single-family rental.

Unlike single-family homes, the value of apartment buildings is based on the income they generate. If you improve the building and increase the rent, the building becomes worth more.

You will need some money upfront for things like deposits and visiting the property, but you get reimbursed when you buy the property. You mostly use other people’s money to buy apartment buildings, so you don’t need much of your own money.

One of the best parts about multifamily investments is its tax benefits. You get tax breaks from things like “cost segregation,” which lets you write off about 60% of your investment in the first year.

I also like how MF performed over the past 5 plus decades, in particular in the Great Recession and during Covid. People always need an affordable place to live, so even in down markets, the demand for affordable housing is strong.

Conclusion

As we look towards 2025, it's crucial to understand these diverse strategies for real estate investment. Each method has its benefits and challenges, and the best choice depends on your financial goals, risk tolerance, and investment capacity.

My favorite – the asset that helped me build and scale my real estate portfolio – is multifamily. It ranks high in the criteria I provided at the beginning of the article and outperforms the other assets in times of economic downturn.

If you’d like to learn more about exploring multifamily investments and how you can get started, I have a library full of free resources you can check out, from podcasts to YouTube videos.

I hope this real estate asset class comparison helps you develop a better understanding of different assets and get a feel for the different strategies investors will be using in 2025.

To your success,

Michael Blank

Do You Want to Scale with Real Estate?

book a call with our team