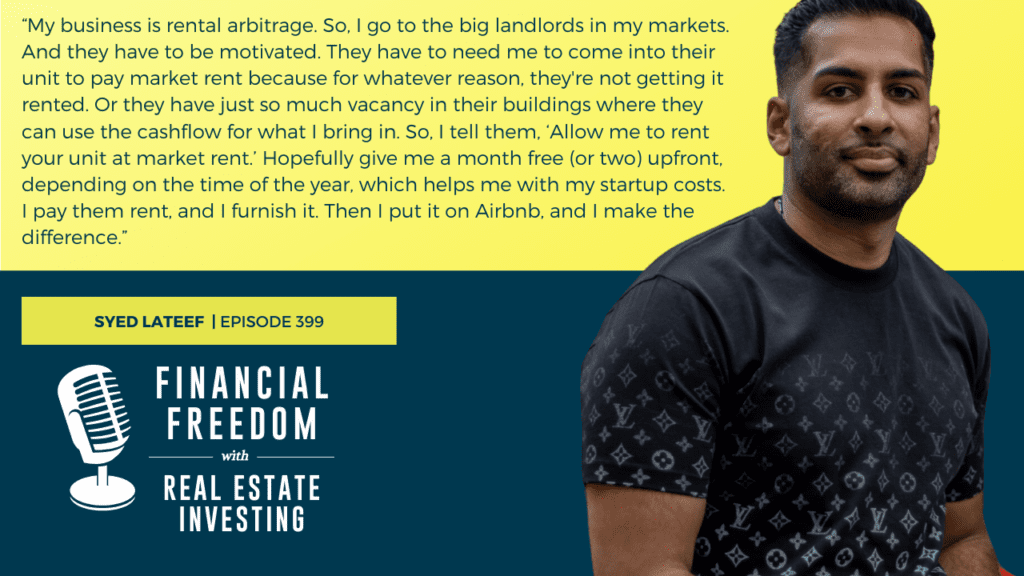

MB399: Can You Achieve Financial Freedom with Short-Term Rentals? – With Syed Lateef

There are risks associated with running short-term rentals, especially when your Airbnb units are in a multifamily building. But Syed Lateef has found a way to scale a STR business in apartment buildings. Listen in as Syed explains how he mitigates the risks, using rental arbitrage to achieve financial freedom with short-term rentals.

MB318: High-Stakes Problem-Solving as a Class D Multifamily Operator

Before you invest with a multifamily operator, it’s important to understand their track record. To know that they’ve got experience overcoming obstacles and making a deal work. Listen in as podcast cohost Garrett Lynch discusses his experience managing class D assets in crime-ridden neighborhoods and describes the high-stakes problem-solving skills he learned along the way!

MB308: To Scale Fast in Multifamily, Partner Up – With Patrick Grimes

Multifamily real estate is a big game. And if you want to scale quickly, you can’t do it alone. But how do you get a senior operator to invite you into a deal? Today, Patrick Grimes explains how he leveraged partnering to go from 0 to 1,200 units in under two years!

Can You Buy An Apartment Building Without Using Your Own Money?

Do you want to get started with apartment buildings, but you think you can’t because you don’t have enough money? Hang on to your hat, because the truth is, you don’t need to be rich to buy an apartment building. You don’t have to save hundreds of thousands of dollars to get started. […]

How to Evaluate Multifamily Deals

https://youtu.be/zalSeHM_gSo Do you have an interest in multifamily investing, but don’t know how to properly evaluate a deal? Today, we’re going to share effective ways to tell if a multifamily investment can be a solid investment. How to Evaluate Multifamily Deals When we look at apartment buildings, there are three clear-cut things we look […]

MB306: To Scale Your Business, Put Investors First – With Veena Jetti

When you’re doing your first multifamily deal, scaling the business is the last thing on your mind. But if you don’t think about scale early on, you’ll be fighting fires as you grow. Today, Veena Jetti explains how she built a portfolio of 3,000-plus units worth $600M with systems that put the investor first.

Active vs. Passive Real Estate Investing 101

If you want to invest in real estate, you have options. You can start out as a passive investor or an active investor. Which one is best? The answer is, there’s no right answer. Both active and passive investing have their benefits, it all comes down to which one is right for you […]

MB305: The Life and Times of an 18-Year-Old Syndicator – With Alex Mandaro

At age 18, Alex Mandaro is the youngest mentoring student we’ve ever had. So, we’re doing an experiment and asking Alex to document his journey on our social channels. Today, Alex explains what inspired his interest in multifamily and why he believes you can be a successful syndicator without experience or cash of your own!

MB299: 2021 Year in Review & Market Outlook for 2022

One of the best things you can do for yourself at the end of each year is take time to reflect on what you’ve learned and achieved. Today, I look back on our journey as a company in 2021, celebrating our wins and sharing our market outlook for multifamily in the year to come!

MB296: Getting Brokers to Take You Seriously – With Savannah Arroyo

Savannah Arroyo talked to 50 brokers before she found one who was willing to work with her. But that relationship led to three deals in nine months and allowed her to quit her full-time job as an RN! Today, Savannah explains how to get brokers to take you seriously when you’re brand new to multifamily.