You may have heard the prediction that unemployment in the US could reach 30%, and that does sound scary. But what do those numbers really mean? And how would that worst-case scenario impact collections? What should we be concerned about as investors in affordable housing?

Damian Bergamaschi is the cofounder of Damris Capital, a money management firm that leverages data analysis to help its investors achieve financial freedom sooner. Damian leads Damris’ optimization research for all investment models and algorithms and serves as the portfolio manager of the firm’s real estate acquisitions.

On this episode of Apartment Building Investing, Damian joins me to explain how his obsession with data led to investments in commercial real estate. He discusses why affordable housing has been insulated from COVID-19, breaking down what the unemployment rate really means and how government subsidies have had a positive impact in the space. Listen in as Damian calculates projected collections in a worst-case scenario and find out why he is bullish on affordable housing as a reliable long-term investment.

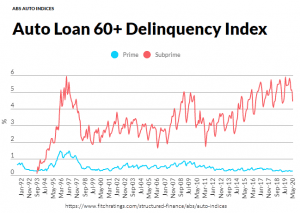

As mentioned in the episode, here is the chart for the auto loan delinquency report:

Key Takeaways

The Damris Capital origin story

- Idea to organize data, info from white papers

- Test different asset classes by numbers

How Damian’s research led him to affordable housing

- Devaluation of dollar = consistent long-term trend

- Residential real estate most tax efficient way to invest indirectly in inflation

- Add framework of Inflation Harvesting (layer on debt)

What we don’t understand about the unemployment rate

- Many people have income despite being unemployed (e.g.: retirement, disability, etc.)

- At 30% unemployment, 60% would still have income vs. 80% in normal circumstances

Why affordable housing is insulated from COVID-19

- Government safety nets (stimulus checks, unemployment benefits)

- More likely to pay for housing than discretionary expenses

- Even in worst-case scenario, 70% collections projected

The adverse short-term impact COVID may have on affordable housing

- Reductions for prepayment

- Slightly lower collections

- Credit card processing for online payments

- Won’t raise rents for 12 to 18 months

Damian’s promising long-term outlook for affordable housing

- Opportunity to raise rents at accelerated rate in 18 to 24 months

- Consistent supply and demand in residential real estate

- As cap rates contract, value of properties will expand

The cyclical nature of delinquencies and being paid up

- Most caught up after tax return

- Most delinquent after holidays

Why multifamily investors need to be thinking about September

- Unemployment will start to hit caps (safety net goes away)

- Renters may owe on taxes, not realizing UEB taxable

Connect with Damian Bergamaschi

The COVID Rent Collection Crisis That Hasn’t Happened (so far)

Resources

Join Michael’s Investor Incubator Mentoring Program

Join the Nighthawk Equity Investor Club

Damian’s Blog Post on Unemployment

Damian’s Blog Post on Mobile Home Park Investing

Damian’s Blog on Mobile Home Park Investing Performance Post-COVID

The Case-Shiller Home Price Index