If you’re a first-time investor in multifamily real estate, you might be wondering how deals come to a close and what happens when there is an exit.

When an investor hears the word “exit” they often equate it to the sale of a property. This is a traditional scenario where the assets are sold, profit is made, and taxes are paid.

What if I told you there are ways to exit a deal that will give you a portion of your money back to reinvest, while deferring tax on your capital gains?

Today, I’ll address options for exiting a deal and how, as an investor, you can determine what to do with your position in a deal that’s coming to a close.

Join us in the video below, or read on.

Refinancing to Increase Return

When a deal is exited, there is something called a liquidity event that occurs. This means that the investor is getting all, or part, of their capital back.

In a traditional asset sale, a property is sold outright and the profits are split amongst the partners in the deal. The partners take their profits, pay their taxes, and do what they please with what’s left.

There’s another liquidity event called a refinance, which is setup to repay an old loan while giving investors a portion (or all) of their original cash investment back.

For example, let’s say a group of investors buys a multifamily property and sets a renovation budget to increase both the value, and the income, of the property. Down the road, 12-36 months later, they can actually refinance the loan at a higher valuation. The loan proceeds from that higher valuation is used to repay the old loan, of course, but also to return either part or all of the capital to the investors.

My team did this fairly recently on a property now called The Davis; a 275 unit property in Huntsville that we bought for $18 million dollars. We’re putting $4MM in improvements to the property to make it look pretty, raise the rents, and increase its value.

Related: Uncovering Value-Add Opportunities

Let’s say that you are a Limited Partner in this particular deal and you're investing $100,000. How would this impact you when the deal is refinanced?

When we first purchased the property, our Net Operating Income (NOI) at the time was about $1MM a year. After we go in there and make improvements, say over the course of 12-18 months, we are able to increase the NOI to $1.5MM.

We are now full in at $22MM. Based on this new NOI, the valuation has increased to $25MM.

We are in a prime position to refinance the original loan, and return 51% of the investor capital. As an investor that put in $100,000, you will get about $51,000 back and STILL have $49,000 in the deal.

The best news is, as we refinance and turn more capital in the deal, your return as an investor increases. The $49,000 that you have in the deal will earn at a higher rate than it did previously.

When we did this before the cash-on-cash was 1%, but when the property value increases the cash-on-cash skyrockets up to 6.3%.

How does this happen?

Basically, when we’re turning more and more of the investor's capital, there’s less and less capital in the deal. There is also less risk.

Let's say we can return 80% of the investor's capital back. The risk is off the table. The investor now doesn't really care too much if we're going to hold onto the property for another 10 years because they're still going to get cash flow distributions on that non-taxable event.

The return on the investment goes up because it is measured by your cash distribution divided by the amount of money you have in the deal.

Related: Cash-on-Cash Versus Overall Return

That’s one example of an exit. As an investor, a refinance is preferable because you get some of your money back while keeping some of it invested in the deal.

Let’s take a look at another scenario.

Selling a Property

What happens when a property is sold outright? As an investor, is your only option to pay your taxes on the capital gains and move on?

In a straight sale scenario, that’s typically what happens. But there is another way called a 1031 tax deferred exchange.

With a 1031, you can take the proceeds of the sale of a property and use it to buy another property of “like kind” to defer paying capital gains. “Like Kind” means the new property must be of the same nature, even if differing in quality or grade.

To qualify, the property must be used for business, trade, or investing.

You might be wondering if all of the investors have to agree to move forward with the exchange. What if one of the partners wants to pull their money out?

The answer – If you have it set up correctly, only the majority of investors would need to agree.

We are exploring the 1031 option with some of our properties today, but in my mind, the ideal scenario is to do the refinance/hold strategy.

With a refinance, there is no taxable event. You still get your money back and can hold onto the property. But if you sell the property, you have to deal with both a taxable event and reinvestment risk.

The Risks of Selling

In this environment, valuations are sky high and it’s a great time to sell. But what if you get out of a deal and there’s nothing available to get in to?

Let’s be clear; there are a limited number of opportunities available out there. While you may make a bunch of money on a sale, you have less likelihood of identifying a new opportunity to invest the money. That’s the truth.

We talked to passive investors recently that sold an investment for a large capital gain. They wanted to roll it over into a triple net property, which is great, but the returns are so low that they can't really find a suitable object.

The other risk is uncertainty. No one knows what the future will hold. At some point, all investors ask themselves, Should I sell now? Should I stay in? What are the cap rates going to be?

At the end of the day, you want to make sure your money is working. The one downside of investing in multifamily syndications is that your money is tied up. It’s illiquid. But the upside of that coin is that it's constantly working and being compounded.

If you are thinking about selling, the one thing to take into consideration are the tax implications. I’m not just talking about capital gains tax. There is something called an UBIT – Unrelated Business Income Tax – that you may have to pay depending on how you are invested.

If you’re investing with your IRA, be aware that you can be taxed for UBIT within your IRA. This is due to the fact that the investment is leveraged. The solution is to create an EQRP and transfer your traditional Roth or IRA into this plan to avoid this tax.

A partner of ours, Damion Lupo at Total Financial Control, works with our investors to put these in place as we near the end of a deal. We have a few posts that address this process specifically.

If you’d like to learn more about UBIT tax and EQRPs, check out the resources below:

Planning for the Future

I’m a planner and I love to help other investors plan for the future. My goal is to help as many people as possible become financially free.

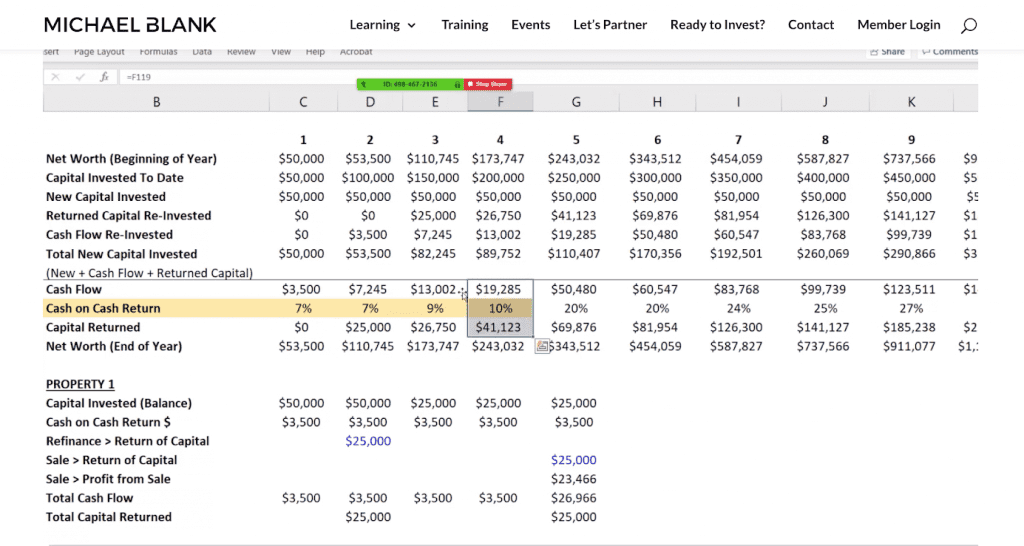

I created a calculator that I call the Passive Investor Income Calculator that will help you run projections. It’s a free download, so I encourage you to check it out and have some fun planning out your passive investment.

Here’s a screenshot of the spreadsheet:

The calculator will help you answer questions like, How much money do I need to invest over how many years? Or how long until I have X net worth or X amount of cash flow?

Be sure to watch the video that explains how the calculator works.

Speaking of videos, we are putting new content like this out every week, so subscribe to my YouTube channel to make sure you are seeing the latest videos.

We are also doing new deals, so if you’re interested in joining and being part of future deals, head on over to Nighthawk Equity and click the “Join” button. We’ll set up a call and put you on our upcoming investment list.

As always, thanks for joining and we’ll see you next time!