HAVEN'T DONE YOUR FIRST DEAL? WHY NOT??

HAVEN'T YOU DONE YOUR FIRST DEAL YET? WHY NOT?

What's holding you back?

Is it knowledge?

Confidence?

Inability to take action?

Fear?

Lack of Support?

If you answered yes to any of these questions, you might want to consider …

MENTORING WITH MICHAEL BLANK

The most effective program on the planet to help you do your first apartment building deal. Because once you do that first deal, the “Law of the First Deal” takes over and you're just 2-3 years away from financial freedom.

As a mentoring disciple, you’ll work directly with one of our highly experienced mentors who have successfully replaced their income with apartment buildings. Yes, they’ve already done what you want to do, which is to become financially free. In addition to providing their own experience, they’ve been trained in my unique 12-month training program designed to help you do your first deal so that you can become financially free in the next 3-5 years.

Just a word of warning though…

WE DON’T ACCEPT EVERYONE INTO THE PROGRAM. WE’RE LOOKING FOR ACTION TAKERS, WHO ARE WILLING TO DO THE WORK. SOMEONE WHO REALLY WANTS TO CHANGE HIS OR HER LIFE. IF THAT’S YOU, THEN WATCH THE VIDEO BELOW AND IF YOU THINK MENTORING MIGHT BE RIGHT FOR YOU, SCHEDULE A FREE STRATEGY CALL WITH US.

WHAT DO YOU NEED HELP WITH?

BRAD TACIA

MENTOR

Brad was an engineering manager for a car parts manufacturer, and saw many of his friends lose their jobs in the recession. He was working 50+ hours per week and had to explain to his daughter each night that he had to work the next day. He wanted to quit his engineering job by going into real estate, and began pursuing a single family rental strategy. He determined that it would take too long and decided to switch to multifamily.

He then did 3 deals, totaling 87 units, and covered his living expenses. Total elapsed time? Just under two years. Since then, he’s accumulated a total of 160 units and is looking for more. He shares Michael’s passion about helping others do their first deal so that they too can become financially free like he did.

Listen to Brad on the Apartment Building Investing Podcast:

Episode 55: How I Replaced My Income With Multifamily in 2 Years – With Brad Tacia

Episode 73: The Secret to Quitting Your Job With Real Estate – With Brad Tacia

Episode 228: What’s Working Now to Get Deals Done – With Drew Whitson & the Michael Blank Mentoring Team

DREW WHITSON

MENTOR

Drew Whitson has been investing in real estate for the past decade as a passive investor and as a syndicator. After quitting his corporate job he joined the business faculty at Bethel University in St. Paul, Minnesota as a Professor of Finance. He is also one of the mentors with the Michael Blank program. He and his wife have a litter of kids and live in the greater St. Paul area.

Listen to Drew on the Apartment Building Investing Podcast:

Episode 183: Pursue a Meaningful Life Through Multifamily Investing – With Drew Whitson

Episode 199: What’s Working Now to Get Deals Under Contract – With the Michael Blank Team

Episode 228: What’s Working Now to Get Deals Done – With Drew Whitson & the Michael Blank Mentoring Team

MATT BRAWNER

MENTOR

Matt and his partners have achieved considerable success turning their $5,000 investments into a portfolio worth more than $20M, but his greatest passion is teaching. Today, Matt and his wife live in Minneapolis with their three kids. They are active in their church and enjoy all that Minnesota has to offer. Real Estate has given Matt and his family the gift of being planted and he wants to help you do the same.

LISTEN TO MATT ON THE APARTMENT BUILDING INVESTING PODCAST:

Episode 228: What’s Working Now to Get Deals Done – With Drew Whitson & the Michael Blank Mentoring Team

Episode 240: How to Get Unstuck & Get Into Action – With Matt Brawner

ARLEEN GARZA

MENTOR

As a Principal and Co-founder of REEP Equity, Arleen oversees the operational aspects of their multifamily portfolio along with serving as a decision maker on acquisitions and company growth strategy. In overseeing the management company, REEP Management, her goal is to maximize investor returns by increasing revenue, while controlling expenses for the properties under their ownership umbrella.

Arleen received her Bachelor’s in Business Administration in Finance from Texas Tech University. Prior to establishing the real estate business, Ms. Garza served in various senior level key roles in the financial services industry, achieving the title of Senior Vice President. In addition, she served as Vice President for Bank One (predecessor of Chase Bank) serving in key roles as Retail Banking Center Manager, International Private Banking Manager, and as a Credit Officer.

After leaving the corporate world, Ms. Garza established a consulting business through which she worked together with entrepreneurs in developing marketing strategies and human resource strategies to achieve accelerated growth.

Arleen launched her initial real estate investing business in 2012. She and her husband began with a small 24-unit property which they owned and managed. As a Principal in REEP Equity, they have sponsored a total of twelve multi-family acquisitions, taking four properties full cycle with total returns as high as 370%. Currently, her multifamily portfolio consists of 2,621 units as a deal sponsor and passive investor in San Antonio, Atlanta, Dallas, Jacksonville, and Houston. In 2017, she was instrumental in starting a management company which currently manages eight properties in San Antonio and has over seventy employees.

JEREMY LEMERE

MENTOR

Jeremy LeMere, a 25 year manufacturing engineer, purchased his first duplex in 2010. He began investing with the goal of retiring by the time he turned 55. In 2011 he completed his 3 year MBA journey. Leveraging the opportunity in the foreclosure market, he began rehabbing single family homes in 2013 to build a strong equity position in his portfolio. In the spring of 2017 he experienced a career disrupting event that pushed him to scale up more quickly. In 2018 he closed on a 28 unit apartment property. Three months later he closed on an 8 unit property that allowed him to become financially free from his engineering career, thus achieving his goal by the time he was 45.

Since 2018 Jeremy has continued to diversify his investments by expanding his personal rental portfolio, passively investing in out of state assets, providing hard money loans, and syndicating deals (including a recent 289 unit multi site self storage operation). Jeremy spends time helping others learn about real estate by participating in local REIA organizations and the apartment associations, actively encouraging others to get into real estate.

LISTEN TO JEREMY ON THE APARTMENT BUILDING INVESTING PODCAST:

Episode239: Developing a Can-Be-Done Mindset for Multifamily – With Jeremy LeMere

BARRY FLAVIN

MENTOR

Barry Flavin has been investing in real estate for over 8 years. He started by rehabbing and selling several of his personal residences, then using the proceeds to purchase 30 single family rentals. After realizing the many opportunities that real estate has to offer, he shifted his focus to multifamily. As of 2020, Barry now owns 387 units. Prior to pursuing real estate as his main focus, he had a successful career in software sales, followed by air traffic control. Barry’s passion ultimately lies in real estate Investment relations. He enjoys sharing his knowledge and opportunities with current and future Investors, with a focus on stable and reliable returns while creating long-lasting relationships. Barry graduated from Western Michigan University in 2005.

LISTEN TO BARRY ON THE APARTMENT BUILDING INVESTING PODCAST:

Episode 238: Plug into a Multifamily Network & Fast-Track Your Success – With Barry Flavin

DREW KNIFFIN

MENTOR

Drew accidentally became a landlord in 2008, when he couldn’t sell his condo, and rented it instead. That’s when he realized the power of real estate and hatched a plan to quit his job. He dabbled with a few rentals over the years but was frustrated with how slow the progress was. New Year’s Eve of 2014 he decided to get started with small multifamily buildings. In just 8 months (and 3 deals later), he had covered his living expenses and quit his job. Today he controls over 188 units and doesn’t see himself slowing down. He is super excited to help others do their first deal and become financially free like he was able to do.

Listen to Drew on the Apartment Building Investing Podcast:

Episode 27: Slow and Steady to Quit Your Job with Multifamily Investing

Episode 141: Under the Hood of Asset Management for Multifamily Syndicators – With Drew Kniffin

Episode 199: What’s Working Now to Get Deals Under Contract – With the Michael Blank Team

PHILIPPE SCHULLIGEN

MENTOR

Philippe started his multifamily career thanks to Michael Blank’s program; it took Philippe just 5 months after joining the program to close an 80-unit deal. Now he is sharing his experience with new multifamily entrepreneurs as a mentor.

Philippe is the founder of Five Five Five Ventures, a firm dedicated to assist professionals to navigate Real Estate alternative investments.

Prior to being full time in real estate, Philippe worked a corporate job in the business jets aircraft industry in various leadership roles for over 20 years. He holds a Master’s Degree in Science – Mechanical Engineering. Philippe, his wife, and two daughters live in Atlanta, GA.

LISTEN TO PHILIPPE ON THE APARTMENT BUILDING INVESTING PODCAST:

Episode 265: Build Relationships, Build a Multifamily Business – with Philippe Schulligen

DAVID KAMARA

MENTOR

David Kamara bought his first rental duplex in 2006 and slowly continued to buy single-family houses. David pursued a career in management consulting where he advised private equity buyers on M&A, business process improvement, and cost cutting initiatives. The excessive work travel and time spent away from his family drove David to invest in multi-family properties more aggressively. He became a Michael Blank mentoring student and did 4 deals that year. David never looked back and continues to invest in multi-family property on his own and with investors, as a syndicator and operator. David currently owns over 200 units and lives in the greater Detroit area with his wife and four daughters.

Watch David's episode with Michael.

Listen to David on the Apartment Building Investing Podcast:

Episode 182: An Action-Oriented Approach to Financial Freedom with Multifamily – With David Kamara

Episode 241: What to Say to Potential Multifamily Investors – With David Kamara

KYLE MITCHELL

MENTOR

Kyle Mitchell is a real estate entrepreneur who has a focus on Multifamily Syndication, and currently has $17MM AUM. He is the Managing Partner and Co-Founder of APT Capital Group and the Asset Management Summit. Their mission is to positively impact the lives of their investors and the communities in which they invest through the highest level of transparency and fiduciary responsibility.

Kyle is also the co-host of the weekly real estate podcast, Passive Income through Multifamily Real Estate, where he speaks with various experts in the real estate industry to help educate and create clarity for passive investors.

With a background in operations, management and logistics, he has overseen multi-million dollar businesses, and has a passion in doing the same in the multifamily syndication space.

LISTEN TO KYLE ON THE APARTMENT BUILDING INVESTING PODCAST:

Episode 172: Building an Investor Pipeline for Multifamily Syndications – With Kyle Mitchell

WHAT DO YOU NEED HELP WITH?

4 MONTHS TO FIRST DEAL – 69 UNITS – NOW OWNS 500+ UNITS

It took Patrick just 4 months after joining the program to close his first deal – 69 units – by partnering with Michael Blank's team. He paid himself a nice $19,038 acquisition fee check at closing. Since then, he has quit his job and closed another 500 units.

4 MONTHS TO CLOSE FIRST DEAL – 57 UNITS!

It took Tom only 4 months after joining the coaching program to close his first deal – 57 units – by partnering with Michael's team. He's on to much bigger deals now!

CLOSED MY FIRST DEAL – 9 UNITS – BEST COACHING OUT THERE!

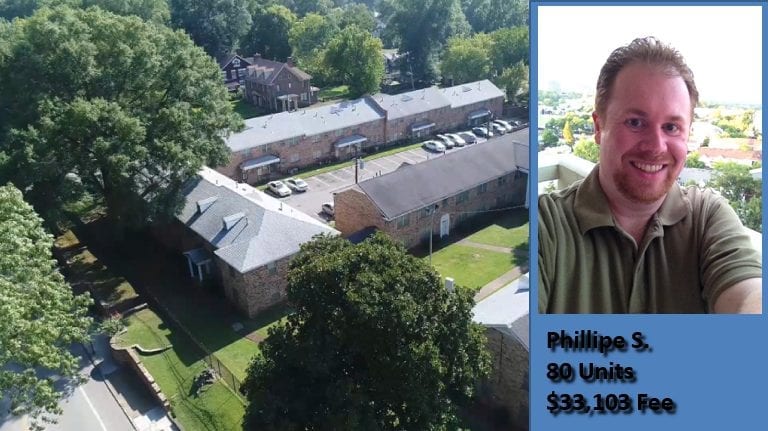

5 MONTHS TO CLOSE FIRST DEAL – 80 UNITS

It took Philippe to close this 80 Unit deal just 5 months after joining the program by taking advantage of Michael's Deal Desk. He paid himself a nice $33,103 acquisition fee at closing, too. He's now weeks on closing on his 2nd deal – a monster 168 units.

DON'T SIGN UP NOW – SIGN UP YESTERDAY!

NO ONE BETTER FOR MULTIFAMILY!

ON TRACK TO DO MY FIRST DEAL THIS YEAR

9 MONTHS TO CLOSE FIRST DEAL – 138 UNITS – NOW 300+ UNITS

It took Bruce F. only 9 months after joining the program to close his first deal – a monster 138 units in the Dallas/Ft Worth area. Six months later, he closed 100 units, then another 80 units in 6 months. Within just 2 years, he had $15K per month in passive income – nice, right?. BTW, he recently sold that first deal for a $1M profit!