RECENT BLOG ARTICLES

On this episode of Financial Freedom with Real Estate Investing, Paula joins me to explain the importance of building a team to achieve greatness in multifamily.

On this episode of Podcasts, Jason shares his insights on the supply and demand challenges driving up prices, the impact of rising interest rates, and the factors contributing to the housing affordability crisis.

In this blog post, we’ll explore the changing landscape of multifamily real estate. With the market showing significant shifts, there's less risk and more opportunity than ever before. This is why now is the perfect time to invest, learn about the current market conditions, and find out how to make strategic decisions that can lead to substantial wealth creation. Whether you're a seasoned investor or just starting, this post provides valuable insights and practical advice to help you succeed in multifamily real estate.

In to this episode of Financial Freedom with Real Estate Investing, where hosts Michael Blank and Garrett Lynch sit down with special guest Joe Fairless from Ashcroft Capital and the Best Ever Real Estate Show.

Many investors I work with are hesitant about real estate, particularly single-family house rentals, due to high interest rates. They think waiting for rates to come down will get them a better deal. That might be true for single-family houses, but not for apartment buildings.

In this episode, Damion talks about an ambitious venture to tackle the housing shortage in America—Frametech. With a vision to streamline and revolutionize construction processes, Frametech is set to establish up to 100 fully automated plants, significantly reducing construction waste and time. Michael and Damion explore how determination and resilience are key traits for finding success.

Landlords in California can't keep tenants from having dogs in their apartments anymore. Not only that, but they also can't charge extra for pets in the building. And California isn't the only state making these changes.

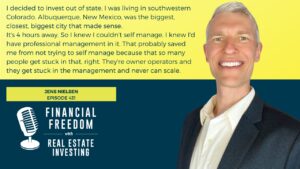

In this episode, Jens emphasizes mindset as the primary stumbling block to achieving financial independence. He shares how connecting with a bigger vision and understanding the pain of the current situation can be powerful motivators for change. Jens also discusses the strategic importance of professional property management, the four pillars of apartment investing success, and the role of building strong broker relationships.

Are you about to start your real estate investing journey? Before diving in headfirst, it’s essential to understand what you’re about to get into, especially if you plan on going it alone.